THE UNITED STATES IN 1929 AND MEXICO IN 1995. A COINCIDENCE?

In 1929 the United States entered into a Great Depression which is considered the worst economic crisis in the history of that country and one of the worst in the history of mankind. During that time millions stood in long lines waiting in the cold for a plate of soup, a piece of bread and a shelter to sleep. People worked entire weeks for enough money to buy a dozen eggs, a gallon of milk or a few vegetables. Children stayed home from school because their shoes had no soles. The Great Depression was so long, deep, severe and traumatic, that laws and traditions were reformed and the whole country was reshaped. Twenty years later the United States emerged as the most powerful empire in history.

The experiences gathered by the American people are valuable lessons that should be taken into consideration by both Mexicans and the international community in the explaining of the Mexican crisis, since this historical analysis demonstrates that currently, the country is undergoing a Great Depression similar to the one suffered by the United States in 1929. This Great Depression, which is a man made economic disaster, has been conceived for decades, but the crash of 1995 triggered the explosion (or is it implosion?).

Before we begin it is important to assert that this is one of those scenarios analysts fear and wish would never happen, however, in 1996 and beyond it has great possibilities of occurring. It is key to take the necessary precautions and identify the opportunities, because both will surely surface in a crisis of this magnitude.

It is said that those who do not know history are condemned to repeat it and in this case, the US history is well worth analyzing, since in it we can find the fundamental pieces to understand the complex puzzle of the Mexican reality and to propose the possible solutions to help Mexico emerge as a strong country, just as the United States did half a century ago.

Part One

Historical Background

The boom of the late 1920’s

After the chaos brought by World War I the European governments, in their effort to accelerate the rebuilding processes of their nations, imposed highly expansionist tax and monetary policies. This resulted, by the mid 20´s, in an appreciable inflation that was threatening to grow and spill over to other countries like the United States. In Germany, in the early 1920’s, inflation grew intensely provoking a large economic crisis that scared other governments which in turn implemented more orthodox economic plans, and even returned to the golden standard that was forcibly abandoned during the war. After a short and rather mild recession in 1924 that lasted about a year, the United States regained its growth which appeared to be vigorous and healthy by all standards.

The boom of the late twenties was fueled by four sectors of the economy: the automotive industry which in turn fueled others like steel, rubber and gasoline. The building industry because roads were needed and suburbs started developing; then there was the buildup of the electricity infrastructure. The fourth was the financial sector which brought about the biggest illusion of wealth in history.

Output increased dramatically during the boom of the late twenties; agricultural production rose over 10 per cent, industrial production 20.7 and international trade nearly 21 per cent. Capital formation was a healthy 18 to 20 per cent of the GNP and the real gross domestic product grew by almost 30%.

Technological innovations helped American workers become the most productive worldwide; the US economy accounted for over 40 per cent of world output. During the entire decade between 1919 y 1929, productivity advanced more than 60 per cent in manufacturing, output per worker 72% and the time to produce a unit of output decreased 30% . Yet wages advanced only 10% causing per capita income to advance only 1.2 percent yearly.

The strength and duration of the boom prompted in many the thought that the economy was immune to turnarounds in the business cycle. In the United States prevailed the idea that the riches were unlimited. Americans lived better than ever and the urge to enjoy all comforts of modern life generalized a boom in credit. As industries turned out millions of units of output, advertising standardized the buyers; mass production joined forces with mass media and a whole new range of goods complemented with new selling techniques became available for the American consumer. In an editorial, that depicts very accurately the feeling that prevailed in the time, the New York Times hailed the American businessmen with the following comment: "You business executives sitting at your desks, you have been making the fairy tale come true. Within ten years you have done more toward the sum total of human happiness than has ever been done before in all the centuries of historical time" .

Despite the positive outlook, economic growth in the United States was not healthy after 1925. Europe had recovered a great part of its productive capabilities, both agricultural and industrial, and new countries were entering the nations economic concerto, specifically primary producers such as Argentina, Australia and Canada. This increased the current supply of products causing a flood of goods and services worldwide.

The producers of raw materials such as coal, the agricultural sector and the older industries such as textiles were specially affected, for they saw their prices plummet.

Even as the costs of labor and raw materials fell, manufacturers did not lower their prices accordingly (the ratio that existed between agricultural and industrial prices was 139 to 156). This made industrial profits grow at a rate of 80% during the twenties, rising far more than wages and productivity . The profits were not distributed equally among the shareholders, management, the workers and the providers of raw materials. Hence, as the decade approached it’s end, farmers were unable to purchase the finished products made with their crops and workers found it impossible to buy the goods they themselves had produced.

The purchasing power of the middle classes also declined. 21.5 out of the 27.5 million families in the US in 1929 earned less than US$3,000 a year, which made it very hard to consume and even harder to save . But sellers had an answer to all those who lacked liquidity: consumer credit. Through monthly payments it was possible to buy from radios and washing machines to cars and houses. 50 per cent of all the cars sold during the decade were paid for by installments . The expectation of a prosperous future made up for the lack of current income and everyone bought on credit thinking that their incomes and businesses will continue to grow indefinitely. Credit was so easy to obtain that by 1929 the population was literally swimming in debts.

But the most impressive boom took place in the financial markets. In 1929 one and a half million Americans had invested in the stock market trying to get rich quickly. Many of them bought shares on margin paying only part of the price for the companies shares. Profits were reinvested in the market and that caused prices to rise even higher. During 1928 for example the price of Radio Corporation of America (RCA) stocks had grown from 85 to 420 even though it had never paid a dividend. DuPont was 525, up from 310. Also the various industries were strongly monopolized, especially utilities, and the big corporations reported huge profits. This helped to fuel the rise in stock prices.

In most industries the establishment of trusts tended to have a severe influence over prices. The increasing economic and financial concentration represented a severe opposition to the free interaction of market forces. Unions did the same thing to the labor markets by trying to keep wages artificially high. Credit was another variable which greatly impaired the operation of the market forces. All the above interfered with the economic cycles and their ability to eliminate the excesses of supply and demand, of production and consumption.

The financial system lacked proper regulation and the Carnegies, the Mellons, the Morgans and the Vanderbilts owned colossal industrial, banking, service and financial conglomerates and were able to manipulate the markets according to their wishes. Wealth was highly concentrated and by 1929 the richest 27,500 families had as much money as the poorest 12 million .

Despite the optimism that prevailed in the twenties, the US economy was developing severe structural problems that later would surface. As the past situation progressed, consumption markets began drying up and production started to fall substantially. The first to fall was the construction industry which pulled down many others, but afterwards other sectors, like transportation, were affected. By July 1929, the industrial production index had reached its peak. When the crash occurred in October of that same year, the index had already been declinining for three consecutive months.

Finally, it is important to point out that social insecurity was at its highest, mainly in the large cities. The Volstead Act, that prohibited the production and distribution of spirits, was passed in 1920 and allowed the rise of such characters as Al Capone who headed the new and uncontrollable bootlegger Mafia. There were as many as 219,000 illegal saloons, 500,000 persons were convicted of alcohol-related activities and yet crime grew and murders became common-place rising from 6 to 10 per 100,000 . Corruption infiltrated into the highest political and public security levels and some mobsters were socially recognized for their predominant economic position; money became the most important issue, regardless of how it was obtained.

Under these conditions, in January 1929, republican Herbert Hoover took office as President of the Unites States. He had held the position of Secretary of State under the Coolidge administration. The economy was growing, therefore he began his term very optimistically to the point that he promised the continuation of the policies of the previous years and forecasted a new era of prosperity that soon would reach all the American People.

In his address accepting the Republican nomination he forecasted an era of eternal prosperity and the full disappearance of social and economic problems, beginning with extreme poverty: "We have not reached the goal, but given a chance to go forward with the policies of the last eight years, and we shall soon, with the help of God, be within sight of the day when poverty will be vanished from the nation" . But history had a surprise prepared for President Hoover and eight months after his inauguration, the stock market crashed wiping out billions of dollars in a whiff.

Summarizing the situation that led to the Great Depression, there were large structural imbalances such as the worst agricultural crisis in the history of the United States, the greatest level of income and wealth concentration, a high level of monopolization of industry and services, low salaries and the plunge in purchasing power of the middle classes. Therefore it is safe to say that the boom of the late 20´s was fed by low wages, abundant credit, low raw material costs and a high degree of financial speculation. It was a growth both artificial and unsustainable.

By mid 1929 what anyone would expect in such an environment happened, a fall in investment projects, placing the economy of the United States in the verge of a recession. Only a minor blow was needed to trigger it, and such blow (which was not minor by any means) came in October 1929.

Main causes behind the Great Depression of the 1930's in the United States

| 1) Businesses were making more profits than ever but the core of this money was paid off to the stockholders and very little was destined to wage and benefit increases for the workers. |

| 2) Prices did not fall as productivity increased and the capital and labor ratio was altered. Workers could not buy what they produced. |

| 3) International trade seemed to be in a boom, however balances were not healthy. The United Stated had a great trade surplus fueled with speculative capitals invested in other countries’ shaky securities. |

| 4) The United States industry had a very high degree of monopolization, especially in the utilities sector. |

| 5) Concentration of wealth hit a peak in 1929. 8% of the families received 42% of national income while the lower 60% received only 23.7%. |

| 6) Many basic industries such as textiles and coal, highly labor intensive, were abandoned. When consumers stopped buying autos and appliances the entire economy collapsed. |

| 7) The unions weakened considerably during the 1920's, and lost their ability to collective bargaining. |

| 8) Agriculture was going through it's worst crisis which aggravated with a terrible drought in 1930. |

| 9) There were no social benefits such as unemployment insurance, deposit insurance or social security. |

| 10) The financial crack of 1929 knocked out the confidence of the investors. |

| 11) The great industrialists where also bankers and financiers. |

| 12) Prohibition fostered a boom in organized crime and insecurity took hold of the entire population. |

|

Part Two

The Salinas Years

Main causes of the Great Mexican Depression of 1995

In forty years history books may not consider the crisis of 1995 as a great depression, but they will certainly consider that income distribution in 1994 was the worst that ever existed in Mexico. In other words, most of what will be written in forty years about the Mexican crisis has already been defined, only the outcome is missing. Or is it?. Whether the Mexican crisis is a great depression or merely a recession, it has already stated many unanswerable truths that remove a great deal of significance to the outcome.

The situation that prevailed in the country prior to the crash of 1995 has great resemblance with the boom of the late 1920's that preceded the great depression. The Salinas administration, hailed and applauded around the globe, made serious mistakes that caused great structural damage to the economy. Some of the problems started long before Mr. Salinas took office, even long before he was born, however during his administration they all became worse.

During the 80's the Mexican economy stagnated and inflation reached three digits, causing great instability and propitiating the growth of the radical left.

In 1987, after the October crash where the Dow lost over 500 points, Carlos Salinas, who had already been appointed by his predecessor to succeed him as President of Mexico, implemented an orthodox "shock plan", an economic model full with classical, liberal or supply side oriented recipes and even returned to a kind of "golden standard" (in the case of Mexico the fixed parity of the peso vis-à-vis the US dollar) that was forcibly abandoned during the hyperinflationary 1980’s. After a short and rather mild recession in 1988 that lasted about a year, Mexico regained its growth which appeared to be vigorous and healthy by all standards.

The boom of 1989 was triggered by three industries: electric power, construction and automobile manufacturing which in turn caused other industries such as steel and mining to advance. The fourth industry that should be given credit for the growth in Mexico in the early 1990's is the financial sector which created one of the biggest investment illusions of history.

Between 1989 and 1992 the classical model was harvesting good results; economy grew at what seemed a healthy three and a half per cent annually, inflation was dropping and wages were increasing moderately. Investor confidence was high and both domestic and foreign investments were flowing into the country.

The Mexican international trade was also growing however balances were not healthy. The fight against inflation became the highest priority of the economic policy and in order to achieve the very ambitious goal of lowering inflation to one digit, the government opened the borders, reduced tariffs, even allowed dumping of Chinese and Korean products against which Mexican small and medium size companies could not compete. Current account deficit grew every year as imports rose faster than exports until imports accounted for 25% of the economy and trade deficit hit 7% of GNP.

The Mexican government abandoned many basic industries to compete in the cut-throat foreign markets. Sectors such as textiles, plastics and footwear which are composed of thousands of small and medium size companies and create hundreds of thousands of jobs, were left to compete against the conglomerates, both domestic and foreign and against the very aggressive and highly seasoned Oriental manufacturers.

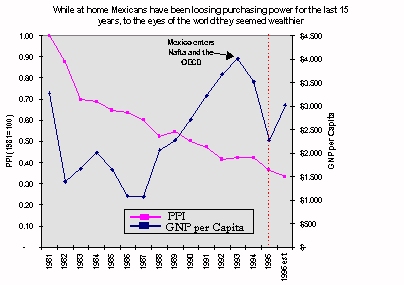

GNP was rising at 3.5 per cent annually in pesos, however in dollars the rate of growth approached 11 per cent due to the fact that the government implemented a sort of golden standard keeping the value of the peso semi-fixed against the dollar. The prices of the Mexican products soon approached those of the United States and by 1993 they had surpassed them because the Mexican inflation was high by international standards and the government refused to let the peso devalue in order to adjust the imbalances.

The Mexican agriculture was in the midst of its worst crisis in history. Some blame the commodities markets for their volatility and unpredictability, but reality is that the blame cannot lie on the prices of raw materials but in erroneous government policies that date back decades. This crisis has already led to a peasant uprising in the southern state of Chiapas partly because Salinas passed a very tricky reform of the agricultural sector that has aggravated it's crisis.

GNP was growing, however productivity was rising even further. In every year of the Salinas administration, productivity rose above GNP, yet salaries augmented very little. Despite the low cost of labor and raw materials, prices did not go down and as a result workers had no money to buy what they produced and peasants did not have enough to buy the finished products made with their raw materials.

Middle classes stand among the casualties of the Salinas administration because with the trade liberalization policies, the prices in Mexico tended to equal those of the United States, but the wages remained 10 times lower and sometimes even more. This combination destroyed their purchasing power, however the government had an answer to the lack of liquidity of the middle classes; credit. During the Salinas administration credit cards were granted freely and suddenly everything became available on comfortable monthly installments, from refrigerators and vacuum cleaners to homes and cars. This created the most impressive credit boom in the history of the country; the resulting liquidation is equally dramatic.

If the middle classes were among the most affected by Salinas, the upper class and the big conglomerates stood as the winners of the entire process. The degree of economic monopolization and the concentration of wealth was alarming and greatly surpassed the indexes reached in the United States in the 20´s. Industrialists are also bankers and brokers, their financial decisions are based solely on their quest for increasing their conglomerates without considering the macroeconomic damages they might be inflicting.

The Carnegies, Mellons, Vanderbilts and Morgan reincarnated in Mexico under the names of Slim, Hernández, Garza Sada and Romo, all of them owners of impresive industrial, financial and services conglomerates who control vast industries and are positioned at the top of the productive chains. The Mexican government, far from imposing regulations on these cancerous economic cells (gobbling everything on their path), encouraged them by allowing merges between conglomerates, by granting them huge subsidies and by selling them government owned companies. The famous "trickle down economics" that Clinton ran against in 1992, are a reality in Mexico and have caused tremendous damage to the country’s economy.

Finally there is the delicate issue of organized crime which grew exponentially during the Salinas administration. After the army, drug dealers have become the major organized armed force in the nation and they greatly surpass the police in logistics, equipment and number of recruited individuals. It has infiltrated the highest political and economic spheres and many drug lords became accepted in the upper social circles mainly because of their money. Insecurity and crime are growing everyday throughout the entire country and murders, kidnappings, drug smuggling and muggings are reaching record highs.

Under these conditions, President Zedillo took office in December 1, 1994 and in his inauguration address he forecasted an era of prosperity: "Today, in front of us, we have an opportunity without precedent to achieve the economic growth that the people demand".

To summarize the above, the so-called economic growth during the Salinas administration was motivated by a severe deterioration in wages, an explosive increase in debt and a plunge in costs, the latter not resulting in lower prices, increased salaries or reinvestment in the primary sector. As a result, the great mass of workers do not earn enough money to buy the things they produce, peasants cannot buy the finish products that use their raw materials and the middle classes are so much in debt, that they completely lost their purchasing power. The domestic market has virtually disappeared and the quality of life of the people has been deteriorating constantly for the last 15 years.

Only a minor blow was needed to trigger the depression and that blow (which was not minor by any means) came in December 1994.

Parallelisms with Mexico in 1994

| 1) Big businesses were making more profits than ever but the core of this money was paid off to the stockholders and very little was destined to wage and benefit increases for the workers. |

| 2) Prices did not fall as productivity increased and the capital and labor ratio was altered. Therefore workers could not buy what they produced. |

| 3) Foreign trade seemed to be in a boom, however balances were not healthy, Mexico had an enormous trade deficit fueled by short term speculative investments of international funds. |

| 4) Wealth is even more concentrated in Mexico in 1995 than in the United States in 1929. |

| 5) The great industrialists are also bankers and financiers. |

| 6) The economy is monopolized to a very high degree. The government lacks regulatory mechanisms. |

| 7) Agriculture has been declining for many years and has now reached its worst crisis ever. |

| 8) Unions were considerably weakened and workers have lost their bargaining power. |

| 9) Social benefits such as deposit insurance, unemployment insurance and social security are either poor or nonexistent. |

| 10) The speculative economy dominates the productive. For the government, the variables that affect the first one, have priority over those that impact the second one. |

| 11) Many basic industries highly labor intensive were abandoned. |

| 12) The drug lords and corruption are advancing without control. |

|

Part Three

The nature of both depressions

Differences between 1929 and 1995

The risk of extrapolating historic events that occur in different places at different times and with different actors is very high because there is a tendency to magnify similarities and minimize, sometimes even overlook disparities. At this point it is only fair to review those events that do not coincide and there are certainly a few, some of them favor a more optimistic scenario for Mexico but others make matters much worse.

1) The nature of the downturn

Many analysts contend that after a decade of growth, in 1929 the United States and the world were ripe for a recession and that it was inevitable. The Great Depression may have been triggered by a downturn in the economic cycle, but the structural problems of the economy were responsible for the worsening of the recession until it became a depression. It was both a cyclical and a structural crisis.

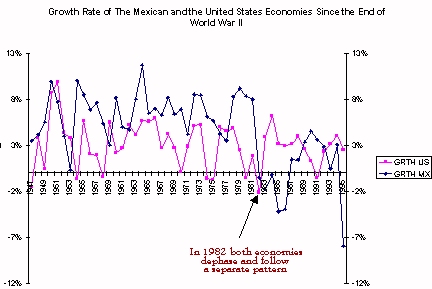

In the case of Mexico the structural damages are evident but it is not clear that the downturn of 1995 was cyclical in nature. It appears more as if an external blow was responsible for the debacle and a proof is that the Mexican economy has been de-phased from the American since the eighties. The following chart illustrates how, from the end of World War II and until 1982, the growth rate of both economies followed a similar pattern with a slight lag in the case of Mexico. But in that year, the Mexican economy parted and began following it’s own pattern of growth, opposite to the United States. This pattern has both governments very worried because Mexico is counting with the continuous growth of the United States economy in order to recover. However the US economy could enter another recession by 1997 when, according to the Mexican government, the country’s economy will begin to grow.

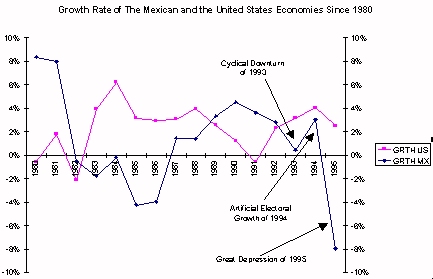

The second chart, which is merely a close up of the last fifteen years of the first one, also shows that the cyclical recession occurred in Mexico in 1993 and the slump continued throughout the first quarter of 1994, however early in the second quarter of that same year, the government poured billions of dollars into the economy in order to win the elections. This irresponsible thrust to the economy may be considered as the first blow and one of the main causes of the downturn.

Another blow came from the political arena were the Machiavelic and Calligulistic policies of Salinas started to take their toll and caused kidnappings, political assassinations and other surprising events that kept the economy hostage. The final blow was a combination of factors, first the high level of indebtedness of the government in short term peso denominated bonds pegged to the dollar named Tesobonos and then the inexperience of the administration of President Zedillo to handle any contingencies. The now famous "December mistakes".

2) The scope of the depression

The depression of the 1930’s was a worldwide phenomenon, therefore international cooperation was essential to emerge from the crisis, however the contrary happened, countries everywhere adopted highly nationalistic policies that worsened the slump and started to blame each other for the collapse. The Great Mexican Depression of 1995 is not a worldwide phenomenon although it created the "tequila effect" and caused great instability across the globe. International solidarity, so scarce in 1929, was very generous in the case of Mexico for the entire world had to come up with an aid package that amounted over 50 billion dollars. The lion share of this resources came from the United States.

3) An anchor too burdensome

In the 1920’s external factors such as huge debts incurred by many countries during and after the War, commercial unbalances between nations and the saturation of markets had also influenced the situation. The depression was far more traumatic for European countries such as Germany that were highly indebted. However the United States was a creditor nation and her problems were in the collection of payments not in coming up with loads of foreign currencies to meet interest payments. The case of Mexico is different for the country is highly indebted, it owes slightly over 200 billion dollars and that is a very heavy load when one country needs to emerge from a slump of this size.

4) Crisis on top of crisis

When Herbert Hoover became President of the United States of America, the country had enjoyed many years of prosperity. The Republican Party was very strong, the Democratic Party was restructuring in order to compete in the future, the only major threat was ideological in nature and it was called communism, but besides that minor detail (because the growth of communism happened after World War II) the United States lived in peace and enjoyed a very healthy political system and a very consolidated democracy. Unfortunately Mexico is not entering this crisis with a trustworthy political system nor with a democracy and this aggravates the distress. The ruling PRI is also declining and it is eroding the entire country; the political system does not ensure the peaceful solution of the problems nor the coexistence of political forces. Opposition parties have not reached the maturity needed nor national penetration, they lack presence in many regions and mostly they do not represent a real option.

5) What countries are made of...

At the turn of the century, the United States accepted massive inflows of European immigrants that arrived in America searching for the land of opportunity. Many had no resources but they all had a common objective, the greatness of the nation through their personal prosperity. Besides guts they had another very important asset which was education. Mexico does not have the human capital that the United States had in the 1930’s. The level of education is grossly inferior, the Mexican people are getting used to the idea that Mexico is not a land of opportunity. There is a lack of a common objective, no view of an historical project and most of all, there is no confidence for opportunities have never been equal. This might be the biggest difference and the hardest one to overcome.

But there are also similarities such as the inability of the governments to handle the contingencies, their search for scapegoats outside their countries and that both depressions were triggered by crashes in their financial sectors. Last, but not least, both in the 20´s and in 1995, the predominant philosophy was economic liberalism and Adam Smith’s theories were followed blindly and government rules and regulations were often based on insufficient information for the collection of statistics were grossly inaccurate both in the United States in the 1920’s and in Mexico in 1995.

Timely implemented enlightened government policies could have alleviated the crisis then and now. But it is difficult to believe that a depression could have been avoided altogether for structural damages were great in both instances. Also, lag effects would have required the appropriate action to have been taken few months before the peak and governments would have needed the foresight, skill and aptitude to do so, which clearly at the time they had not, especially in the case of Salinas, more preoccupied with his passage to history than the welfare of the nation.

Milton Friedman and Anna Schwartz, in their "Monetary History of the United States" write "The collapse from 1929 to 1933 was neither unforeseeable nor inevitable. It could, in fact, have been greatly moderated by policies that there was every reason in advance to expect would be followed". The same could be said for the Mexican debacle and it would be a very interesting question to pose to Mr. Friedman and Mrs. Schwartz.

Both stories begin with financial crashes, one in October of 1929 in Wall Street and the other in December of 1994 in Paseo de la Reforma. Both killed the confidence of the investors.

Part Four

The Great Economic Depression of 1929.

A crisis of historical magnitude

On Wednesday October 23, there was an unexpected fall in stock prices. There had been many warnings, Wall Street was feeling pretty restless and that anxiety extended to the rest of the country. The following day, prices plummeted, falling harder by the minute and by 11:00 AM it had turned into an avalanche. Panic engulfed the market and by the end of the day 13 million shares had changed hands. But the worst had yet to come. On Monday, October 28 the losses worsened and the day after -Black Tuesday- is still considered by historians as the most devastating in the history of financial markets. 16 million shares changed hands and many could not find buyer, no matter how low the price. By mid-November, 30 billion dollars had disappeared, the same amount of money spent during World War I .

Political and business leaders took a long time to grasp the events. By the time they understood the crisis it was already too late, it had turned into the worst economic nightmare of American history.

Right after the collapse in stock prices President Hoover reassured the population that the crash reflected only a financial crisis but that the industries (their manufacturing facilities and distribution channels) were basically sound. Henry Ford declared, in November 4 of 1929 that "Things are better today than they were yesterday"; Hoover said a week later that "any lack of confidence in the economic future of American enterprises is foolish" and Charles Schwabb, president of Betlehem Steel said in December of 1929 that "never before had American finances been so soundly prepared for prosperity than now" (12). But sooner than later reality proved the President and all the business leaders wrong and they had to accept that the economy was in a profound recession and later a depression of unimaginable consequences.

The crash of the stock market had worsened the already severe structural damages of the United States’ economy, but the worst had yet to come due to the erroneous policies implemented by the US government:

1) In the first place, the Federal Reserve decided to defend the value of the dollar above anything and imposed higher interest rates in order to prevent the money from being turned into gold. The obvious happened, the heavily indebted consumers repudiated their debts due to the rise in interest rates and triggered a banking crisis.

2) Secondly, the FED dried up the economy by keeping the money supply very tight. This submerged the nation in a cash flow crisis and aggravated the crash in both the stock and real estate markets.

3) Finally, in an attempt to fight inflation and maintain a balanced budget, taxes were raised reducing the purchasing power even further.

The most universal example of counterproductive government policy was the effort to keep a balanced budget. Doing so proved impossible because the depression caused tax revenues to decline at the same time that the government was being forced to spend more in relief for the needy. With prices falling, unemployment high and economic activity stagnating, deliberate deficit spending would have provided stimulation to the economy, however the contrary was done, expenditures were reduced to a minimum and additional taxes were imposed. During the period between 1931 and 1932, Herbert Hoover made no fewer than 21 public statements stressing the need for a balanced federal budget. After loosing the election in 1932, he even pleaded Franklin D. Roosevelt to maintain fiscal discipline "even if further taxation is necessary".

These measures were fully backed by the big corporations and the very wealthy individuals to whom the tightness of Hoover’s policies made perfect sense. Regardless of the crisis, many conglomerates such as U.S.Steel, DuPont, Shell Oil, Gulf Oil and General Motors managed to expand. After the crash they were able to buy businesses and properties at basement bargain prices (13). However the policies described above made no sense for the ordinary citizen because by the early thirties the United States’ economy was in obvious depression. Two months after the crash several million people had lost their jobs, many businesses had closed, sellers had been fired and factories had cut their production and decided not to grow further. Office buildings, homes, apartments and hotels everywhere had few tenants and the construction industry came to a complete halt. Banks curtailed their loans and the industry ceased to receive funding. The automotive industry exploded like an inflated balloon, the Ford Motor Company which had 128,000 workers in March of 1929 lowered the payroll to 37,000 eighteen months later. The Metropolitan Life Insurance Company estimated that in the large cities unemployment had reached 24% of the economically active population .

Prices of many goods began to fall as companies sacrificed their margins or even operated with losses. That prompted further layoffs and lower wages which in turn meant less consumption and an aggravation of the slump. Deflation followed the depression and both started feeding each other, creating a vicious circle.

This deflation, the lack of markets and the faulty policies of the government, led to the bankruptcy of thousands of companies and the loss of millions of jobs. Both companies and individuals began to default on their credits and soon banks began to go belly-up and a financial panic spurted. By 1932 over a quarter of all banking institutions in the United States had closed and 9 million people lost their savings.

For the American agriculture, the Great Depression climbed on top of a five year old ongoing crisis. As if this was not enough, in the early thirties the United States suffered one of the worst droughts in history. Banks repossessed farms and ranches, and in the three years that the depression lasted, more than 750,000 farmers lost their land, harvests and animals. These people had to abandon the rural life and migrate to the cities putting more pressure on industrial wages and further expanding extreme poverty and public insecurity.

Children suffered the deeper wounds of the Great Depression which was a very heavy burden for them to carry. Education suffered, schools closed and many children had to work to earn extra cash for the family. Others had no shoes to walk to school. Milk consumption fell everywhere and mal-nourishment problems and other illness caused by weakness became common. Labor laws were violated constantly and even children started working in factories, farms and shops.

The depression was very hard on workers and it almost killed the labor movement in the United States. As jobs disappeared, union membership fell dramatically. The American Labor Federation reported a loss of 1.5 million affiliates from 1920 to 1929 and a further erosion in the years that followed. The ability of unions to bargain collectively was lost and workers accepted lower wages, longer hours and avoided strikes in order to preserve their source of income. By 1933 unemployment was so high that poverty became common. Hoover rejected a proposal to implement unemployment insurance and in exchange offered the jobless 1.5 billion in loans.

This plan, like many others sponsored by Hoover had little success if any at all.

Middle classes stand also among the casualties of the depression. First they spent their savings, then they collected their insurance policies and finally had to sell their jewelry and even their furniture. Then they began to owe money to the convenience store in the corner that later could not repay. Finally they had to move to poorer neighborhoods. More than 273,000 families lost their homes for not paying their mortgages . Professionals, who had been working for 15 or 20 years in their fields suddenly lost their jobs and a college education had meaningless value. Unemployed graduates from Penn, Harvard, Yale, Columbia, Cornell, etc., formed an association. Doctors treated patients for free; teachers worked for charity; writers, artists and advertisers had to accept low paying jobs; small businesses collapsed or were absorbed by the larger firms. By the end of 1933, 85,000 businesses had failed, their losses amounted to many billions . Prices of properties also plummeted and the signs "for rent" or "for sale" were found everywhere.

Many blacks from the South migrated to the North since the depression favored extreme right-wing and left-wing positions. In the United States the Ku Klux Klan and other racist anti-immigrant organizations began to flourish. Borders closed up to new immigrants and in the rest of the world extreme positions developed such as those promoted by Hitler, Stalin, Mussolini and Franco.

As the crisis aggravated, rescue programs started multiplying. The "Hoover hotels", huge warehouses in which homeless people took refuge, long lines of soup and bread giveaways to prevent thousands from starving. Beggars multiplied in every corner and people were willing to work for food. The administration attempted many rescue plans directed to agriculture, unemployment and relief for the small and medium size industries but all of them failed. Hoover created the reconstruction finance corporation and capitalized it with 2 billion dollars, however it was hardly enough, the crisis was already too deep and despite the intervention in 1932 the situation worsened. The mean income of the American worker declined from 1,719 dollars in 1929 to 772 in 1932 and the agricultural GNP declined from 12 billion to 5 billion in the same period. The government tried to subsidize the agriculture however the huge cost associated with this forced the Hoover administration to abandon the project.

Millions had no shoes, yet footwear factories were operating at marginal capacity. Hundreds of thousands had no food, yet gallons of milk and silos of grain were dumped and burned. Meanwhile, concentration of wealth increased. Those who had money invested in government bonds which always honored their obligations even while sacrificing infrastructure, education, social security and public safety projects.

Farmers, workers, businessmen, intellectuals, politicians and even artists asked Hoover repeatedly to abandon the conservative policies of the past. He responded by saying that he would not echo the voices of the demagogic and the irresponsible and that he would stick to the orthodoxy. Herbert Hoover, isolated in the White House, tried to deal with a crisis he could not truly understand, while one quarter of the nation had no regular source of income.

Consequences of the Great Depression of 1929

| 1) When the government dried up the economy and increased interest rates, there was an uncontrollable growth in unpaid loans. Such rise provoked the bankruptcy of many banks and a financial panic. |

| 2) This panic was aggravated by the symbiosis between banks and brokerage houses because the latter utilized the deposits of the first ones to speculate. |

| 3) Consumer markets dried out because of the lack of buying power of the majority of the population. |

| 4) With supply exceeding demand, prices started to fall until deflation took hold of the economy. |

| 5) 85,000 businesses went bankrupt. Their losses amounted to 4.5 billion. |

| 6) Unemployment shot up to over 30% which affected the expectations of the entire society. |

| 7) Emergency plans grew exponentially. They came mostly late or lacked proper funding and they failed. |

| 8) Suicide rates and murders per thousand inhabitants grew to record levels. |

| 9) Millions of farmers lost their lands and were forced to migrate to the cities, aggravating the poverty. |

| 10) The huge capitals that accumulated during the 1920's were not reinvested in the economy since consumer markets were dry. When investment fell, the ability to generate savings also plummeted. |

| 11) Racism and xenophobia spread. Borders were closed to all new immigration. |

| 12) The Depression favored political extremes around the world. In Germany the far right (Hitler) and in the USSR the far left (Stalin). |

| 13) The political crisis that began with the depression cost the Republicans the Presidency and Congress which they were unable to recover for nearly a generation. |

|

Part Five

The Great Mexican Depression of 1995

The Worst Crisis of Modern Mexico

It would only take the replacement of the United States in 1929 with Mexico in 1995 and history would seem to repeat itself with few fundamental differences.

In late November 1994, the end of a year plagued with political assassinations, kidnappings and even the threat of civil war in the State of Chiapas, the financial markets started to get very restless, investors got nervous and started to exchange their pesos for dollars. President Zedillo took office on the first day of December but he was very enchanted by his former boss to critical review of the situation. Therefore he did not take the proper measures or precautions and 19 days after he took office, he had no choice but to devalue the peso from 3.5 to 4.0 to the dollar. But the markets considered that a 16% devaluation was hardly enough and two days later the exchange rate hit 6 to the dollar. The crash had started and so did the Great Depression. In the three months that followed anxiety grew even further, the peso hit a low of 8 to the dollar, interest rates surpassed 100% (over five times their pre-devaluation level) and stock prices collapsed loosing in some instances 80% of their value in dollar terms.

Political and business leaders took a long time to grasp the full meaning of the events and most have not realized yet the depth and magnitude of the crisis. Enrique Espinoza of the Interamerican Development Bank (BID) said four days after the devaluation that the drop in the value of the peso did not affected the economic strength of the country. Just a few days after the devaluation the Minister of Foreign Affairs said that the country would emerge from the crisis within a few months.

However reality kept contradicting the statements of the politicians and within a few months of the crash, millions had lost their jobs, thousands of businesses closed their doors and all investment projects came to a complete halt because confidence was completely lost by both domestic and foreign investors. The situation was dramatic and a major rescue package was needed to save the markets from the ultimate collapse. The money came from the United States, the IMF and the World Bank as well as from other governments and multilateral financial institutions who amassed over 50 billion dollars of aid for the collapsing Mexican financial system.

The international community imposed severe conditions on the package that the Mexican government was happy to accept for it has been run by authentic "ayatollahs of neoliberalism" who since the 80's have been willing to fully dry the economy, raise interest rates and break the production, specifically the small and medium size business that does not have access to foreign financing, to prevent the value of the peso from dropping. The high interest rates have created a genuine credit crunch that will deteriorate the economy and the banking system further.

The Mexican government fully backed by the United States government and the IMF made the same mistakes that the Federal Reserve made in 1929:

1) First, they decided to defend the value of the peso above anything and imposed higher interest rates in order to prevent the pesos from being turned into dollars. The obvious happened, the heavily indebted consumers and businesses repudiated their debts due to the rise in interest rates and that in turn has triggered a banking crisis.

2) Second, they dried up the economy by keeping the money supply very tight. This has submerged the nation in a cash flow crisis and aggravated the crash in both the stock and real estate markets.

3) Finally, in an attempt to fight inflation and maintain a balanced budget, sale taxes were raised 50% reducing the purchasing power even more. Sales tax in Mexico is 15% across the country, therefore the poorest peasants in Chiapas pay higher taxes than the richest banker in New York.

The same ruling leaders have opened the economy mercilessly provoking the virtual disappearance of such branch industries as textiles, footwear, toys, candies and others, all of which are labor intensive and owned by members of the middle classes which are doomed to disappear.

Finally, they have focused their whole economic policy towards keeping a balanced budget. In order to do so they increased taxes and cut federal expenses, particularly in the areas of investment, same mistake made by the Hoover administration sixty five years earlier. The result, a rich government and a poor population, a very healthy macro-economy and very ill micro-economy, as contradictory as it may sound. Mexico has its own Herbert Hoover who is maintaining the orthodoxy of the past above any other consideration.

The collapse of the financial markets was followed by a collapse of the real economy. Among the casualties special attention should be focused on the Mexican agriculture which has been devastated for many years and the crisis has been aggravated by one of the worst droughts in history, just as happened in the United States in 1930. The rise in interest rates has put many farmers in the verge of extinction and the crisis of the primary sector has originated many political movements like the "Barzón" which is a union of debtors that originated in the fields. This group is gaining strength as other sectors with debt problems pool into their midst, just as it happened in the US in the 1930’s.

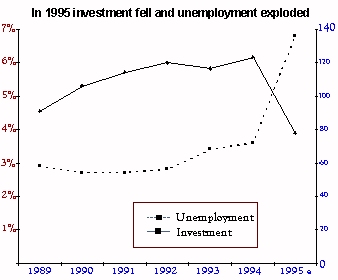

Production is working at less than 50% capacity and unemployment reaches far beyond the 30% that the US economy underwent in the 1930´s. As industrial production plummets, unemployment increases causing a lack of consumption. Industrial production falls even further in a never ending viscious circle, just as the stories told by individuals who suffered the Great Depression of 1929.

Economic downfall comes together with stock, real estate and investment crash. But the financial panic does not stop at the fall of the peso or the stock market and may very well turn into a full fledged banking crisis. The possibility of more banks and financial groups declaring bankruptcy (over 50 per cent have already been intervened by the government or have incurred in emergency programs) has not been dissolved. It is estimated that at least US $15 billion have been used to rescue the bankers in Mexico so far and as many as US$20 billion more are needed, according to Salomon Brothers. The un-collectable loans total 25% of all loans outstanding as of July 1996.

With the economic collapse, the poor have certainly gotten poorer, some of the rich made fortunes, but the more affected are the middle classes. Hundreds of thousands of white collar workers have been laid off, professionals who had been practicing for years have lost their clients and patients, young couples are loosing their homes and many are selling their jewelry and their furniture; a college degree has become meaningless and many graduates of the finest Mexican universities are unemployed; 60 thousand children were moved from private to public schools sacrificing the quality of their education and expectations of a brighter future which are dimmer everyday; small businesses are collapsing, thousands of them have failed and their losses amount to many billions. Prices of properties are also plummeting and the signs "for rent" or "for sale" are found everywhere, meaning that the crash has spilled over to the real estate market, just like it happened in the United States in the 1930's.

Finally, at present the most profitable business in Mexico is organized crime, from drug dealing to kidnapping, through robberies and murders. Unsafety is so high that it can be easily compared to Chicago in 1929, without forgetting corruption, an essential part of the current Mexican scope. Suicides have also grown exponentially, mainly for economic reasons.

In order to grasp the attention of the reader the author decided to include a brief list of some statistics that may help understand the nature of the Mexican crisis in 1995. The reader should judge for himself if they resemble the outlook of the Great Depression of 1929.

¿Recession or depression? Some statistics that invite reflection (All until the first half of 1995 unless otherwise noted)

| The Association of Car Dealers declared a 71.6% drop in car sales from January to July, a 17.5% fall in production and in items like trucks the contraction amounts to 83.9%. It exploded like a balloon. |

| The Chamber of Construction reported a 55% drop in building. |

| The Association of Department Stores and Supermarkets say that their affiliates have reduced sales by 33% and 15% respectively. The drop in sales of home appliances is 60%, 37% in clothing and 24% in general merchandise. |

| The Secretary of the Treasury announced a 30% drop in imports of capital goods and a 20% fall in overall foreign investment |

| 40.61% past due accounts (SAC) |

| 33.89% consumer loans past due accounts (SAC) |

| The think tank of the Mexican businessmen, the CEESP (Center for Economic Studies of the Private Sector) conducted a poll among it’s members: 75.2% of them declared a reduction in sales and 37.2% a reduction in personnel. |

| The equivalent of Fortune, Forbes or Businessweek, a magazine called Expansion also conducted a big money poll which confirms that two out of three companies have reduced their sales and the same percentage declared a reduction in personnel. |

| The Association of Dealers of Machinery and Spare Parts announced an 80% reduction in the sales of machines and 65% in spare parts. Construction machinery fell 90%. |

| President Zedillo said that the Mexican electric power sector requires 30 billion dollars in investments to meet the future requirements of the country. |

| A poll conducted by the newspaper Reforma to managers of banks states that their embargoes have increased 120%. The Mexican Stock Market reports that the profits of the banking system fell 82.3% and Salomon Brothers estimates that up to 30 billion are needed to rescue the banking system. |

| The Department of Statistics reports a 14.8% drop in cement production, and 43.9% fall in the value of such production. The drop in beer production amounts to 32.5% |

| 25% of the publishing and printing businesses will close in 1995 according to the National Chamber of Graphic Industries |

| The National Association of Industrialists of Plastic Products reports a 40% drop in that industry, a loss of 25,000 jobs and a 40% death rate for the companies. |

| The soft drinks consumption fell 20% according to the Association of soft drinks bottlers |

| The Mexican Association of Travel Agencies estimates that 1,500 of it’s members will close their doors during 1995 out of a universe of 5,500. |

|

Conclusion

Differences Between Recession and Depression

Just as pneumonia is not a colossal cold, a depression is not a gigantic recession. They are completely different conditions, have different diagnoses and require different treatments. The country’s drop of private consumption and severe contraction of GNP should not be viewed as a severe recession but as a depression that can still be avoided.

A recession usually lasts for one to three years and the rate of unemployment stays below 12 per cent. When business stagnates for over three years and the rate of unemployment raises above 12 per cent but stays below 20 per cent, the economy may be said to be suffering from a depression. When unemployment rises and remains above twenty per cent and the recession lasts for over six years, the crisis may be considered a great depression.

A recession occurs when the GNP falls in absolute terms or when it grows less than the labor force so that the rate of unemployment begins to rise and aggregate demand falls. A depression occurs when the recession is accompanied by a collapse in the financial system, the fall in demand accelerates and continues for many years causing businesses to vanish, a loss in confidence in the financial system and an unprecedented climb in unemployment.

There are many more differences between both economic phenomena than merely the length and severity of the economic downturn, and they have to do with financial, political, social and even moral issues. They were all present in the United States during the Great Depression and they are present in Mexico in 1995. The following are some of the reasons why the current economic crisis in Mexico should be called at least a depression and most probably a great depression.

| 1) In the Great Depression of the 1930’s in the United States, the rate of unemployment reached 30%, percentage which has been surpassed by Mexico. The number of unemployed keeps increasing as more than one million youths enter the workforce every year. |

| 2) Three consecutive years of recession qualify as depression. In 1993 the Mexican economy stagnated for it grew only 0.4 per cent and in 1994 growth was artificial, fueled by excessive government spending for the election process, but for businesses 1994 was also a bad year. 1995 is for many the third year of a recession and there are great possibilities of her lasting through 1996 and beyond. |

| 3) The standard of living of the entire population has been constantly declining for the past 15 years. |

| 4) Recession may be the low part of an economic cycle, but according to many studies, depression is the low part of an historic cycle. This period is of approximately 65 years and it coincides with the rule of the PRI. |

| 5) In the depressions, the economic collapse is paired with financial panic, stock market crash, currency crisis and a drop in the value of real estate. The only investments that are profitable are precious metals, mining shares and foreign currencies. That was the case during the Great Depression and also during 1995 in Mexico. |

| 6) Concentration of wealth and the growing inequalities do not provoke depressions but are capable of turning any recession into a full fledged depression. Concentration of wealth in Mexico greatly surpasses the index reached by the United States in 1929. |

| 7) Emergency plans have multiplied exponentially. There are several in place for agriculture; for the debtors; for projects of infrastructure; the government is giving away literally tons of food to the needy; there are also many for the collapsing banking system. However none seems to be working. |

| 8) Massive foreclosures, generalized repudiation of debts and a permanent cash flow crisis provoked by a drop in the speed of money are not characteristics of recessions but are common in depressions. |

| 9) Bad economic decisions made by the government such as higher taxes, tighter money and reduced spending have aggravated the slump. |

| 10) Strong deflationary pressures. In the United States prices dropped, in Mexico they are beginning this very painful process. |

| 11) An exponential growth of the non legal economy; flea markets, production of arts and craft in home garages, houses that serve as restaurants, beggars, crime. |

| 12) Social mobilization, collective psychological depression and nil or very poor future perspectives. |

|

In other words, in a recession car sales do not drop 80%, there is no reason for emergency programs, banking systems do not stand in the verge of collapse, companies do not close their doors massively, unemployment does not reach thirty per cent and groups like El Barzón do not emerge. The arguments of the Mexican government fail to explain why, after the economic downturn of December 1994, demand continued to decline. As John Kenneth Galbraith put it in the context of the Great Depression of the 1930’s, there are two questions that have to be answered: first the issue is why economic activity turned down in 1995, but secondly, there is the vastly more important question of why, having started down, it kept going down and down and down reaching unprecedented lows and also why it lasted for so long. Traditional economics answers the first question but not the "vastly more important" second question.

The coincidences are so great that it is well worth to take the risks involved with extrapolating historical events. There are certainly many differences between the Great Depression of the 1930’s and the Great Mexican Depression of 1995 but the resemblance is even greater. The author takes full responsibility for utilizing history as the main tool of analysis although economic, political and statistical evidence will be offered when relevant as well as remarks and opinions of experts in Mexican affairs.

The purpose of this paper is to offer an alternate diagnosis of the Mexican situation and to contribute some possible remedies based upon the historical framework of the Great Depression of 1929, one of the events that marked the history and character of the American People, from whom the Mexicans have a lot to learn.

Rami Schwartz

Copyright © 1996 SIS. All rights reserved.

Revised: August 26, 1996